DeFi Coin (DEFC) - Join the future of Algorithmic Crypto Trading Strategies

The DeFi Coin protocol is a community driven fair launched DeFi Token. Three simple functions occur during each trade: Reflection, LP Acquisition, and Burn.

Watch this quick intro video or jump straight to our step-by-step guide. If at doubt find more infor at FAQs below.

DeFi Swap is a newly launched decentralized exchange that offers a vast range of crypto-centric products and features. The DeFi Swap exchange is backed by the DeFi Coin token.

On DeFi Swap, you can gain access to the following services:

DeFi Swap allows users to earn interest on idle tokens. It’s just a case of connecting your wallet to DeFi Swap and deciding which token you want to stake. APYs are very competitive and staking lock-up terms are flexible.

In most cases, you will get to choose from the following terms:

DeFi Swap rewards long-term holders by paying a higher rate of interest on longer lock-up terms.

As soon as the lock-up term has passed, the DeFi Swap smart contract will transfer the tokens back to your wallet. This will be inclusive of your principal investment as well as any accrued interest.

DeFi Swap makes it very convenient to swap one digital token for another – all without needing to go through a centralized exchange. All you need to do is connect your wallet to the DeFi Swap platform – and decide which two tokens you wish to convert.

Then, after entering the number of tokens that you want to swap, the underlying smart contract will securely take care of the transaction.

Within a couple of seconds, you will notice that your newly purchased tokens will be there waiting for you in your connected wallet. Initially, DeFi Swap will focus on tokens that operate on top of the Binance Smart Chain.

In the very near future, DeFi Swap will offer cross-chain functionality. This means that you will be able to swap tokens on competing blockchain networks at the click of a button.

DeFi Swap also offers yield farming services. This involves lending your tokens to a DeFi Swap trading pair. Trading pairs allow users to convert digital tokens without the need to go through a third party.

Yield farming on the DeFi Swap platform can be highly lucrative – especially if you are providing liquidity to a less popular trading pair.

On each transaction that goes through the DeFi Swap conversion tool, buyers and sellers will be required to pay a fee. As a liquidity provider, you will be entitled to a share of fees collected.

DeFi Swap yield farming tools are ideal for those that seek a regular, passive income stream.

DeFi Coin and DeFi Swap are decentralized finance products. And as such, when using the DeFi Swap exchange to convert tokens, or engage in either staking or yield farming, you will not be required to open an account.

Furthermore, there is no need to provide DeFi Swap with any personal information or contact details, nor any know-your-customer (KYC) documents or government-issued photo ID. This allows you to access decentralized financial services without needing to identify yourself.

There are many benefits of buying and holding the DeFi Coin token, such as:

In addition to staking, DeFi Coin investors can also earn additional income simply for holding their tokens. The reason for this is that each and every DEFC transaction attracts a tax of 10%.

Of the amount collected, half of the DEFC tokens will be distributed to you and other existing holders – at an amount proportionate to your investment.

For example:

It is important to remember that while each DEFC dividend payment might seem small, this operation takes place every time someone buys or sells DeFi Coin.

Therefore the amount of income that you can generate in this manner can increase exponentially. no. it doesn’t follow. what are we trying to say here? the size of each payment is dependent on the size of each individual trade and there is no reason for those to become larger naturally. It does however follow naturally that the more trades there are the larger the sum of payments to holders.

Cryptocurrency investors are, generally speaking, rewarded in the long run through patience– not only in terms of capital gains, but earning interest on your idle crypto investments.

A core offering of DeFi Coin is the ability to stake DEFC on the DeFi Swap exchange. In fact, if opting for a 365-day staking term, you will earn an APY of 75%.

This means that for every 1,000 DEFC that you stake, after a year of holding you will receive an additional 750 tokens.

While half of the 10% transaction tax that DeFi Coin collects is distributed to existing token holders, the remaining balance is automatically allocated to the DEFC/BNB liquidity pool.

This is a crucial element of the long-term viability of DeFi Coin, as it ensures that the token operates in a fully-functioning efficient market. After all, without sufficient levels of liquidity, buyers and sellers won’t be able to trade in a decentralized manner.

Both DeFi Coin and DeFi Swap are have only just set out on their respective journeys – with plenty more features and roadmap targets still in the pipeline.

With its clear source of yield funding, DeFi Coin right now offers the an excellent opportunity for profitable entrance to the DeFi money markets. And because DeFi Coin still carries a small market capitalization, – there is plenty of upside potential to target.

Another major benefit of buying and holding DeFi Coin, is that the project will soon be undertaking its burning program. In a nutshell, this means that the team at DeFi Coin will gradually reduce the overall supply of DEFC tokens.

In doing so, in theory, this will have the desired result of increasing the token price – as the ratio between demand and supply will move favorably towards the former.

Once again, by entering the world of DeFi Coin and DEFC tokens early, you’ll stand to get the maximum benefit from the burning program.

Download Trust Wallet and create a wallet. Keep your seed phrase a secret! Never share it with anyone. Store it securely! Make sure to copy the contract on the right-hand side!

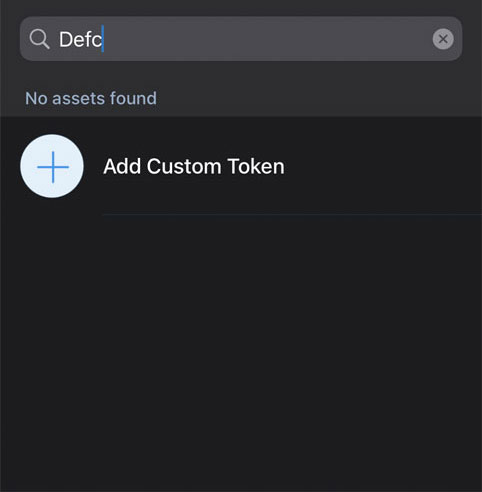

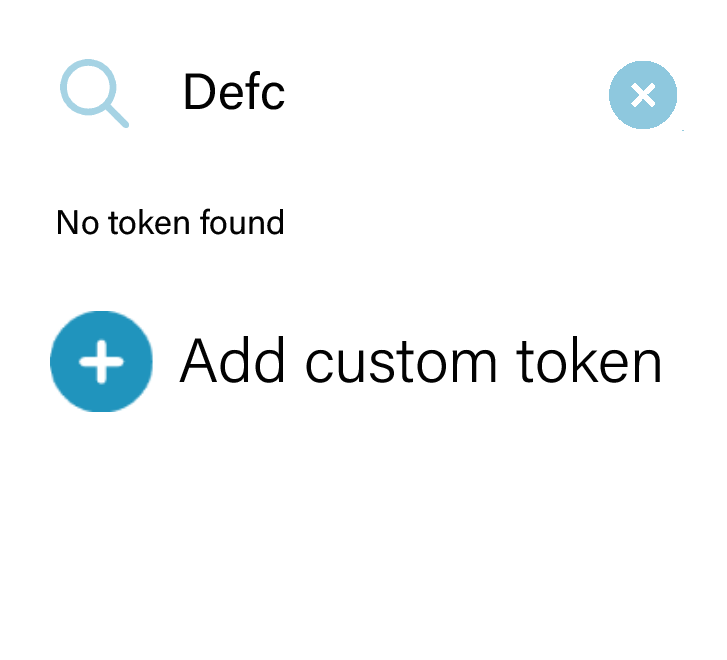

Tap the icon in the top-right and search for “DeFi Coin”. If it’s not there, tap “Add Custom Token”.

At the top, tap “Ethereum” next to Network, and change it to “Smart Chain”. Copy the contract address on this page and put it in the Contract Address box.

Next, put “DeFi Coin” as the name, and the symbol as DEFC. Decimals will be 9.

Click “Done” at the top and you should now have DeFi Coin added to your wallet!

Tap on “Smart Chain” on the main screen of Trust Wallet, then tap “Buy” in the top right. This step may require KYC verification, so have documents ready to prove your identity.

If the transaction won’t go through, you may need to contact your bank to allow international transactions.

After purchasing, there may be a delay while your transaction is processed. Be patient, this is normal!

Once your transaction has been cleared, and you have BSC on your Trust Wallet, Go to DApps (or “Browser” for iPhones) at the bottom of the main screen. If the Browser button is not visible at the bottom for iPhone, open Safari and in the URL type trust://browser_enable, then return to Trust Wallet.

Open the DApps, or Browser, section and find PancakeSwap and open it. Connect your Trust Wallet in the top-right. Scroll down a little to the “Exchange” box.

Click the icon and set the slippage to 15%. If you want to give your transaction the best possible chance to clear, increase the deadline. By default, it should be set to 20 minutes, which is fine.

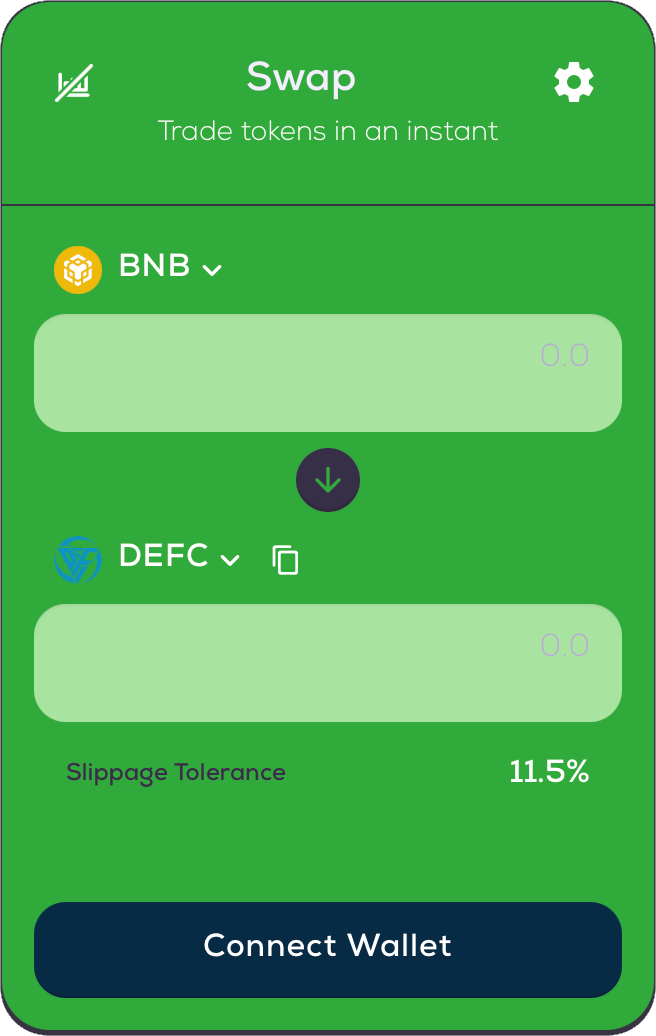

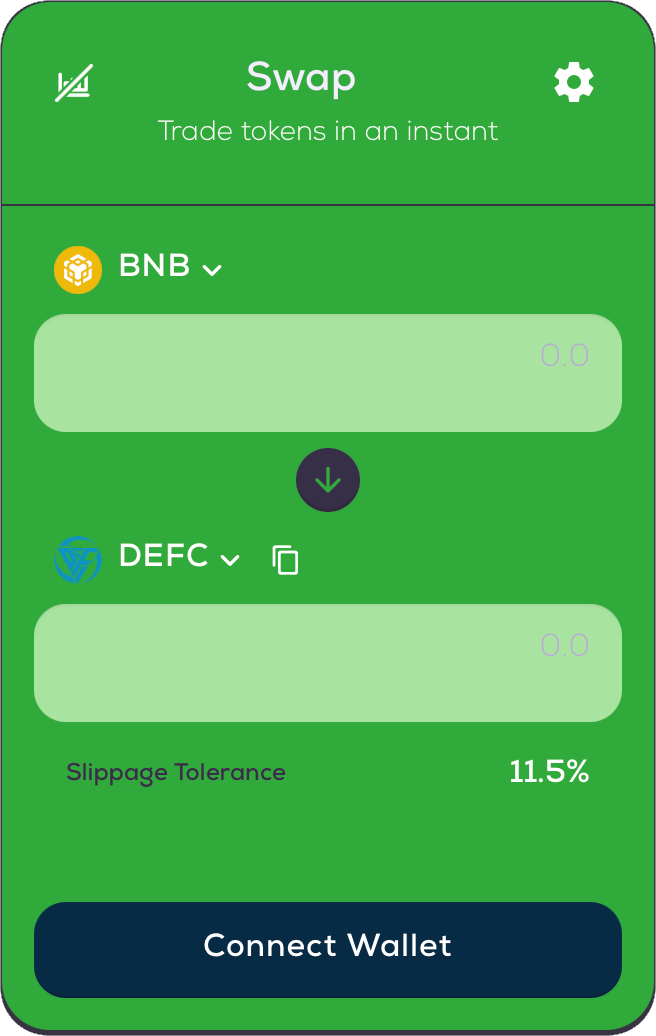

Open the DApps, or Browser, section and head to defiswap.io and click ‘Connect to a Wallet. Find your chosen wallet through Wallet Connect and connect. Click the settings cog icon and set the slippage to 15%. If you want to give it the best possible chance to clear, increase the deadline. By default, it should be set to 20 minutes, which is fine.

Now, all you need to do is specify the amount of DeFi tokens you want to trade. Alternatively, you can also enter the amount of money you want to spend on the DeFi coin in question.

Either way, once you confirm the order at Pancakeswap – it will be executed instantly. Best of all – Pancakeswaap will not charge you a cent in commission or fees to trade DeFi coin!

If you’re looking to build a highly diversified portfolio of the best DeFi coin in the market right now – consider the 10 projects discussed below.